We're Partners. Not Vendors.

Delancey Street get’s it. You want your SEO company to be invested in your success, and help you get results. You want someone who understands the long game and will advise you.

SEEN ON

We're a premier SEO company

Delancey Street will generate success

We handle a wide array of marketing solutions for our clients. We can help you, regardless of your needs. We have a diverse set of skills. We have helped companies across the nation, such as Houston criminal Lawyers, NYC Criminal Lawyers, Trade Show Booths, and more.

optimization

marketing

optimization

marketing

optimization

SEO is one of the most cost-effective ways to generate traffic, leads, and revenue. Period. Everything we do, is to create SEO success for our clients.

- We get you placements on media outlets

- We tell you which keywords will generate revenue

- We help you create SEO landing pages to rank higher

- We track where every lead comes from

- We work with your in-house team to create success

Of customers reported that their online experience begins with search

marketing

Struggling to find PPC experts who drive long term results? Our world-class marketers would love to help your business thrive!

- Keyword and competitor research

- SKAGS (single keyword ad groups)

- Negative keyword pruning

- Ad copy optimization

- Backlink Generation

Of clicks on Search Ads are more likely to buy, making for better leads

optimization

Unlock your website’s full potential and boost your revenue with Numerique’s top-notch conversion rate optimization services.

- Improve contact form completions

- Increase online orders

- Decrease abandoned shopping cart rates

- Accelerate website-generated revenue

- Maximize site design and conversion rates

Of customers reported that they increase the contact form submissions

marketing

Finding the balance between staying current and relying on proven strategies is essential for staying competitive in the ever-changing landscape of marketing.

- Social Media Design

- Social Media Management

- Custom ad strategy

- Unique ad campaigns and ads

- Advanced demographic targeting

Of customers reported an increase in conversion rates through the social media marketing strategies

About Delancey Street

We've been creating SEO success for over 10 years

Delancey Street’s team has been creating immense SEO success for over 10 years, for clients nationwide. We have been effective in multiple verticals.

E-Commerce

We’ve successfully helped huge international brands, such as the BBC, with their e-commerce platforms.

Lead Generation

Our services have been extremely effective in helping lead-generation oriented verticals, such as the legal industry, and other SMB industries.

Web & Branding

We understand best practices when it comes to web design and branding, and know how to execute for brands.

Distributed team of over 20 of the worlds best marketers, podcasters and copywriters

Our customers are some of the world’s...

Most Reputable Businesses In Their Industry

Get your free marketing audit

- 30-min strategy call

- In- depth audit

- Growth Roadmap

Why Numerique

How we drive revenue

Drive Traffic

We figure out what's missing in your strategy, and fix it. Whether you're a Houston criminal lawyer, an NYC criminal lawyer, or Federal Defense Lawyer, we can help.

Create & manage powerful ad campaigns

When you use ad marketing, you create specific messages to motivate people to take action.

Collect, analyze and deploy marketing data

Get the tools you need to collect marketing data, like Google Analytics, and set up processes for collecting and analyzing it.

Improve brand messaging and conversion

Keeping your brand marketing consistent enables you to create a lasting impression that sticks in consumers’ minds and keeps them coming back.

Driving digital revenue for our 1000+ satisfied customers

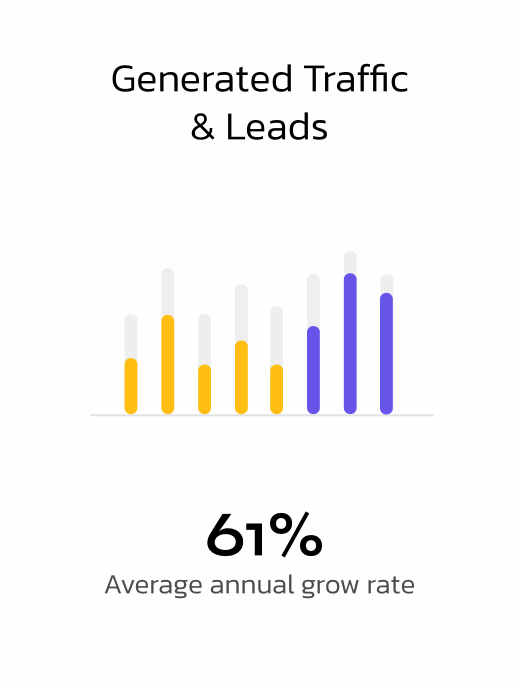

Average Traffic Increase for Clients

The team behind

Team of over 450 experts

At Numerique, we’re focused on building strong and lasting client partnerships. By drawing on our deep industry knowledge and expertise, we provide the insights you need to build and evolve your brand, drive business performance and mitigate risk.